The Treasury’s estimate that Brexit could cause economic damage of 3.4%-9.5% of GDP by 2030 rings true. Although Brexiteers immediately slammed the report as biased, the Treasury uses a well established method to predict the UK’s trade flows under different scenarios.

The underlying theory is that countries do more business with economies that are large and close to them. But other factors, notably trade agreements, also play a role. This is why the UK’s EU membership, which boosts trade with our nearest economies, is so important.

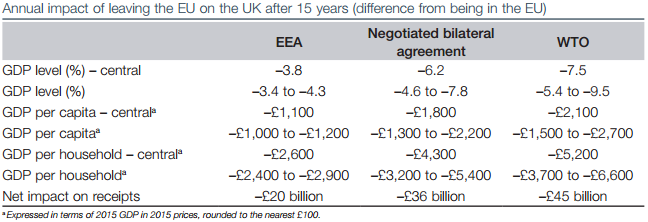

The Treasury considers what might happen to trade under three different scenarios. In each case, it falls. Since trade is good for productivity and investment, a drop is bad for GDP. The Treasury calculates the effect over 15 years, by which time the impact is assumed to have worked its way through the system.

Table from HM Treasury “The long-term economic impact of EU membership and the alternatives”

The first option, trade under World Trade Organisation (WTO) rules, means reintroducing tariff barriers to trade with the EU and an increase in non-tariff barriers. It has the biggest negative impact.

The second option is negotiating a bilateral free-trade agreement (FTA) with the EU on the lines that Canada has. That would reduce the damage. But we’d have less access to the single market, particularly in services, than we do now.

The last option is to join the European Economic Area (EEA), like Norway. That gives us almost complete access to the single market and inflicts the least damage to the economy. But it still means the reintroduction of customs barriers with the EU, making trade costlier.

If anything, the Treasury has underestimated the long-term damage. It assumes Brexit won’t change migration between the UK and the EU. This is plausible for the EEA scenario as access to the single market requires free movement. But given that the Leave camp doesn’t want free movement, Brexit might lead to a smaller population and so a smaller economy.

Moreover, the Treasury hasn’t accounted for future EU reforms. Greater liberalisation of capital and service markets, and trade deals with countries like the US and Japan, could increase UK GDP by up to 4%, according to the Treasury. Much of this would be forgone outside the EU, but isn’t included in the government’s calculations.

Brexiteers might argue that the document doesn’t count benefits from reduced regulation, or making our own trade deals. But these gains are likely to be limited, as the UK already has a competitive regulatory framework.

In theory, we could deregulate even further, as Open Europe a think-tank favoured by Michael Gove, one of the Leave camp’s leaders, advocates. Then, indeed, the economic damage might be mitigated. But with other Brexiteers calling for subsidies to farmers and steel works, such a bonfire of regulations seems unlikely.

The Leave camp responded to the report by rolling out its “wrong then, wrong now” mantra – on the grounds that the Treasury had argued that the euro would benefit the UK back in 1997. It didn’t mention that the Treasury campaigned against Britain joining the euro in 2003. The author of that report, according to the Financial Times, is also the lead writer of the new analysis. One could retort: right then, right now.

Edited by Hugo Dixon

Leave a Reply